For medical providers treating personal injury patients, navigating the financial landscape of settlements and payments can be complex. One concept that frequently comes into play is pro rata distribution. Many attorneys use this method to allocate settlement funds, but what does it really mean for your practice?

In this article, we’ll break down what pro rata is, why attorneys apply it, the legal standing of pro rata in different states, and what you, as a medical provider, need to know to protect your financial interests.

What Is “Pro Rata” in Personal Injury Settlements?

The term pro rata means “in proportion” or “in equal share according to the percentage owed.” In the context of personal injury cases, it refers to distributing settlement funds among medical providers and other lienholders based on their proportional share of the total claims.

For example, if a personal injury settlement is not enough to cover all medical bills in full, a pro rata approach distributes the available funds proportionally among all lienholders, rather than fully paying some bills while leaving others unpaid.

Why Do Attorneys Use Pro Rata?

Attorneys favor pro rata for several reasons:

- Perceived Fair Distribution – If multiple medical providers have liens, pro rata ensures that no single provider gets fully paid while others receive nothing. However, this approach is unfair to certain medical provider segments, as discussed later.

- Client Advocacy – Attorneys represent their clients’ best interests. By applying pro rata, they attempt to reduce a client’s remaining financial obligations after settlement so that their client has no “balance owed.” Attorneys often pressure medical providers and lienholders to accept pro rata as “full and final satisfaction” of their lien obligation.

- Court Precedent – Courts often favor pro rata distribution when settlement funds are limited and multiple lienholders exist. However, whether the patient is relieved of remaining balances varies: some states or courts will relieve the patient of balances remaining, while in most cases, the patient is still responsible for any outstanding medical debt.

How Attorneys Apply Pro Rata in Settlements

When a personal injury case settles, the attorney typically follows these steps:

- Calculates Total Medical Bills and Liens – The attorney gathers all medical provider balances and determines the total amount owed.

- Determines Available Funds – After deducting attorney fees, case costs, and other expenses, the remaining settlement amount is available for medical provider payments. Many attorneys improperly withhold a portion of the settlement for their client (often 25%-33%) before applying pro rata, shifting the financial burden onto medical providers.

- Applies Pro Rata Distribution – The attorney then allocates the remaining amount among lienholders based on their percentage of the total balance owed.

Example of Pro Rata Distribution

Here’s an example of a settlement where an attorney applies the pro rata approach to favor their client:

- Total Settlement: $24,500

- Attorney Costs: $237

- Attorney’s Fees: $8,006 (33%)

- Medical Bills Total: $12,535 (3 providers)

- Set Aside for Patient: $8,006 (33%)

- Set Aside for Lienholders: $8,006 (33%)

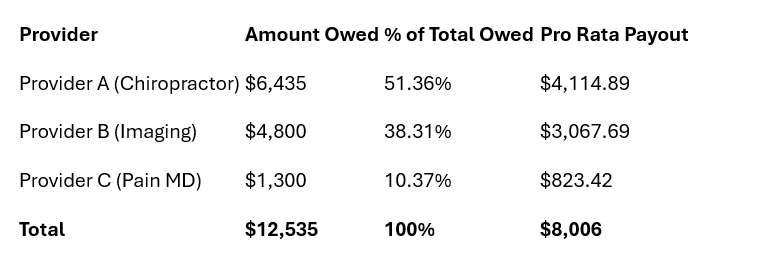

Pro Rata Distribution Calculation:

Even though Provider A was owed the most, they do not receive full payment. Instead, all providers receive a proportional share of what is available.

The Inequity of Pro Rata

Pro rata distributions are often unfair due to differences in medical provider profit margins:

- Chiropractors operate on low profit margins and see patients multiple times.

- Imaging Facilities & Pain MDs typically have higher profit margins with fewer visits.

In the example above, an MRI provider likely accepts around $500 per MRI but is paid over $3,000, while the chiropractor is severely underpaid. This imbalance illustrates why pro rata is not the law in most states and should not be applied universally.

Is Pro Rata a Legal Requirement?

Despite frequent use, pro rata is not a legal requirement in most states. Some states, like North Carolina, mandate a specific set-aside for medical bills, but the patient still owes the balance. Missouri, however, mandates pro rata and prevents providers from billing patients for any unpaid balance.

Interpleaders (legal filings where courts distribute limited funds) often apply pro rata, but even then, providers can typically bill the patient for the remaining balance.

Are Patients Still Responsible for the Balance?

Yes, in most states. Even if pro rata is applied, patients are still legally responsible for any unpaid medical bills unless:

- State law prohibits balance billing

- A provider agrees to accept pro rata as “full and final” payment

Key Takeaways about Pro Rata

- Pro rata means proportional distribution of settlement funds among lienholders.

- Attorneys prefer pro rata to distribute funds and reduce patient financial burdens.

- Pro rata is NOT law in most states, though some require it.

- Courts often favor pro rata in interpleaders.

- Patients remain responsible for unpaid balances in most states.

By understanding pro rata and proactively managing personal injury payments, medical providers can protect their financial interests while continuing to serve personal injury patients effectively.